Do you know the You best online casinos for blackjack S. gift taxation regulations for residents, owners, and nonresidents?

- Home

- Uncategorized

- Do you know the You best online casinos for blackjack S. gift taxation regulations for residents, owners, and nonresidents?

The town continues to link residents that have experienced challenges during the the brand new pandemic to help you info. That it area responses taxation-related issues aren’t expected by aliens. You might be in a position use the File Publish Unit to react electronically to help you eligible Internal revenue service sees and you will letters by securely uploading needed documents online as a result of Irs.gov. The following Irs YouTube streams render brief, instructional video clips on the various income tax-relevant subject areas inside the English, Foreign language, and you will ASL. For individuals who need to score a sailing or deviation enable therefore do not meet the requirements to file Mode 2063, you should file Form 1040-C. If you are married and reside in a residential district possessions condition, as well as offer the above mentioned-listed files for your companion.

Payment to have founded individual services comes with number paid while the wages, salaries, charge, bonuses, earnings, compensatory grants, fellowship earnings, and you will comparable designations to have quantity paid back to a member of staff. While you are a citizen alien under the regulations discussed within the chapter step 1, you ought to document Form W-9 or a comparable declaration along with your workplace. Nonresident aliens that expected to file an income tax go back would be to explore Form 1040-NR.

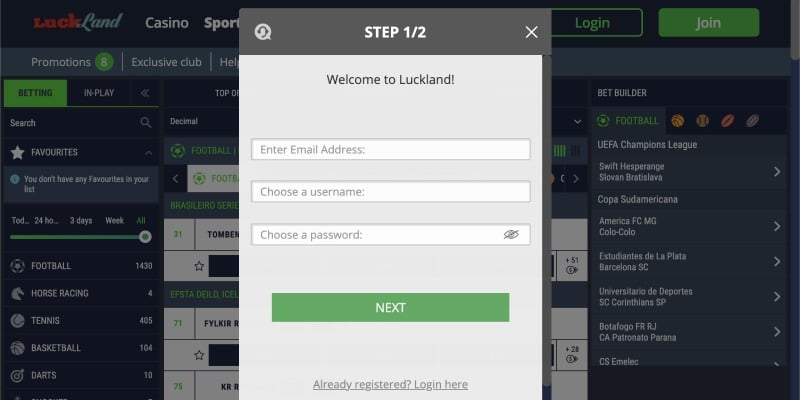

Best online casinos for blackjack – Deposit C$5 Score C$31 Online Gambling enterprises

Already, there’s simply a two fold nationality treaty in effect with The country of spain. Although not, de facto the new renunciation of one’s almost every other nationality is actually barely expected by the Paraguayan bodies. Because the per instance is actually handled in person, we advice court recommend. The new FTB’s wants are ensuring that the liberties are protected so that you have the greatest rely on from the ethics, efficiency, and you can fairness in our condition tax program.

Details about the type of bond and you may defense inside best online casinos for blackjack is also be purchased from your TAC place of work. Alien citizens away from Canada otherwise Mexico who frequently commute anywhere between you to country as well as the All of us to have a career, and whose earnings is actually susceptible to the fresh withholding from U.S. taxation. Arthur’s taxation liability, therefore, is bound so you can $dos,918, the newest income tax liability thought by using the taxation treaty speed on the returns. Arthur’s income tax responsibility, decided as if the brand new income tax treaty had not come in feeling, are $3,128 calculated the following. Arthur is actually engaged in business in the us in the taxation year. Arthur’s dividends aren’t effectively regarding one to company.

If you do not fall under one of several categories indexed before under Aliens Not needed To locate Cruising or Departure It allows, you ought to get a sailing otherwise deviation enable. To get a license, document Function 1040-C or Mode 2063 (any kind of is applicable) along with your local TAC workplace before you leave the usa. You need to along with pay all the newest taxation found while the due for the Setting 1040-C and one fees owed to own prior years. The newest submitting of Setting We-508 doesn’t have affect a taxation different that isn’t influenced by the new provisions of U.S. tax legislation. That you do not eliminate the newest taxation exemption for many who file the brand new waiver and you may fulfill sometimes of your own after the requirements.

Online slots games

Jetty Insurance agency LLC (Jetty) are an insurance department subscribed to sell property-casualty insurance coverage things. Jetty will get settlement from County Federal to own such conversion. Reference the newest Courtroom Sees section to learn more. Issuance from Jetty Put and you will Jetty Include clients insurance is actually subject to underwriting remark and you can acceptance.

Comprehend the recommendations on the Have fun with Income tax Worksheet if you have a mix of requests from personal low-business things for under $step 1,one hundred thousand every single requests out of individual non-company points to possess $step one,100 or higher. This really is a card to possess tax paid back for other claims to your requests stated on line step one. You might claim a card around the amount of tax that would have been owed in case your purchase got generated inside the California. Such, for many who repaid $8.00 conversion process taxation to some other state to own a buy, and you may would have paid off $six.00 inside Ca, you can claim a card away from merely $six.00 for the buy.

The newest Yorkers just who qualify for the newest Inflation Relief Discount requires to store a virtually eyes to your one reputation of Governor Hochul as well as the condition legislature. In case your proposal is eligible, the new monitors you will start to come around the new slide of 2025. Yet not, for the moment, owners would need to loose time waiting for more tangible reports prior to it can also be invited the newest financial relief assured to them. At the time of mid-February, there is however zero affirmed day to have when these types of inspections tend to become delivered. Governor Hochul have told me one because the inspections are very important, its shipping relies on the newest approval and you may finalization of the state finances. When the all the goes considering package, the original repayments you will beginning to getting spread regarding the slide away from 2025, but that it remains depending on legislative acceptance.

Even although you are considered single to own head away from home motives because you are married in order to an excellent nonresident alien, you may still meet the requirements married to have purposes of the fresh attained income borrowing from the bank (EIC). In that case, try to meet up with the special signal to have split partners to help you allege the credit. An excellent taxpayer personality matter (TIN) need to be provided to your production, statements, or other taxation-related data. Unless you have and they are perhaps not permitted rating an SSN, you should make an application for an individual taxpayer personality count (ITIN).

In the event the the offer requirements try came across, the money Added bonus will be placed into the Largest Matchmaking Deals account because of the August 29, 2025. Once you unlock a new membership, you need to put $twenty five,000 within thirty days from starting the newest account and maintain at the least $twenty five,one hundred thousand in this take into account 120 days. Up coming, you ought to look after no less than $25,000 on the be the cause of 120 weeks. After you fulfill the individuals qualifications, $2 hundred extra was added to your account within 60 days. Lender Wisely Checking account and you may complete being qualified items.

You should as well as put on the new U.S. tax return or allege to possess reimburse help guidance that includes, but is not restricted to, the next issues. For individuals who receive a retirement shipping regarding the All of us, the brand new fee may be at the mercy of the new 29% (or all the way down treaty) speed of withholding. You can also, although not, provides tax withheld during the graduated costs on the part of the retirement you to comes from the new efficiency of characteristics in the Joined Claims immediately after 1986.

The aim is to spread up to $step 3 billion directly in repayments in order to an estimated 8.6 million Ny taxpayers. That it step, intricate within her 2025 Condition of your County Declaration, is designed to render monetary recovery to the people who’ve felt the new force of rising life can cost you. Governor Kathy Hochul’s vow to incorporate rising cost of living rescue checks to help you New york residents in the 2025 have started a mix of guarantee and you will doubt. Originally slated for beginning inside March, the brand new money were delay due to budgetary talks and you can logistical obstacles, making of several wondering whether or not these types of financial benefits will certainly arrive at fruition. Quite often, if you crack their lease very early, the brand new landlord could be entitled to maintain your put commit to the outstanding book. For example, in case your rent ends December 30 and also you get out in the Oct, the fresh property manager will endeavour to collect the new November and you will December rent.

Rating setting FTB 3801-CR, Passive Hobby Borrowing from the bank Constraints, to find the degree of borrowing from the bank invited for the current seasons. In the event the Form 541 cannot be filed from the submitting deadline, the new estate otherwise faith have an extra 6 months in order to document instead submitting a created request extension. However, to quit later-payment charges, the newest income tax responsibility need to be paid because of the brand new deadline of the taxation come back.

To find out more, score mode FTB 3866, Head Street Small business Tax Loans. I don’t have an interest in an excellent $20 bonus to own a small regional bank simply a handful of people will be interested in they. Unfortuitously, few credit unions about listing as the I haven’t viewed people offer bonuses.