10 5: Direct Labor Variance Analysis Business LibreTexts

Video slot machine Mayhem Gambling establishment Little Down payment Voucher codes February + 2022 Zero cost Operates Lacking Money Easily + Minute Execute 350+ Fresh Free Casino Spots

آگوست 5, 2024Historical Cost In Accounting Concept & Examples

آگوست 22, 2024

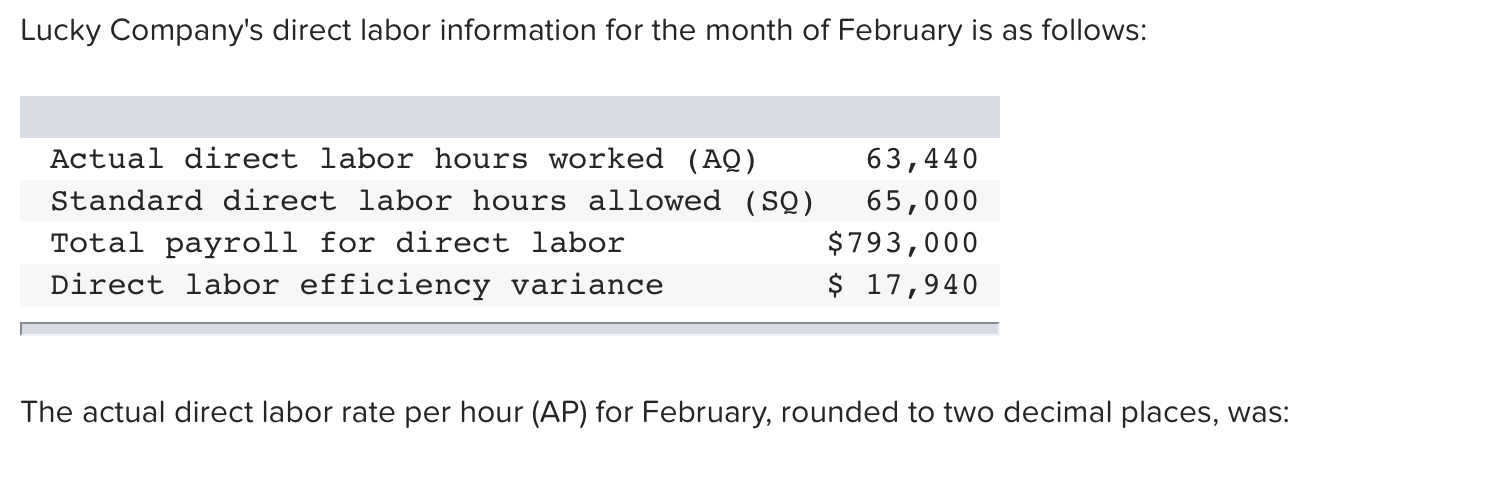

Watch this video presenting an instructor walking through the steps involved in calculating direct labor variances to learn more. The actual hours used can differ from the standard hours because of improved efficiencies in production, carelessness or inefficiencies in production, or poor estimation when creating the standard usage. Background Company B, a large electronics manufacturer, faced challenges with labor efficiency variance. Despite having a highly skilled workforce, they consistently recorded unfavorable efficiency variances. Direct labor efficiency variance pertain to the difference arising from employing more labor hours than planned.

Direct Labor Rate Variance Calculation

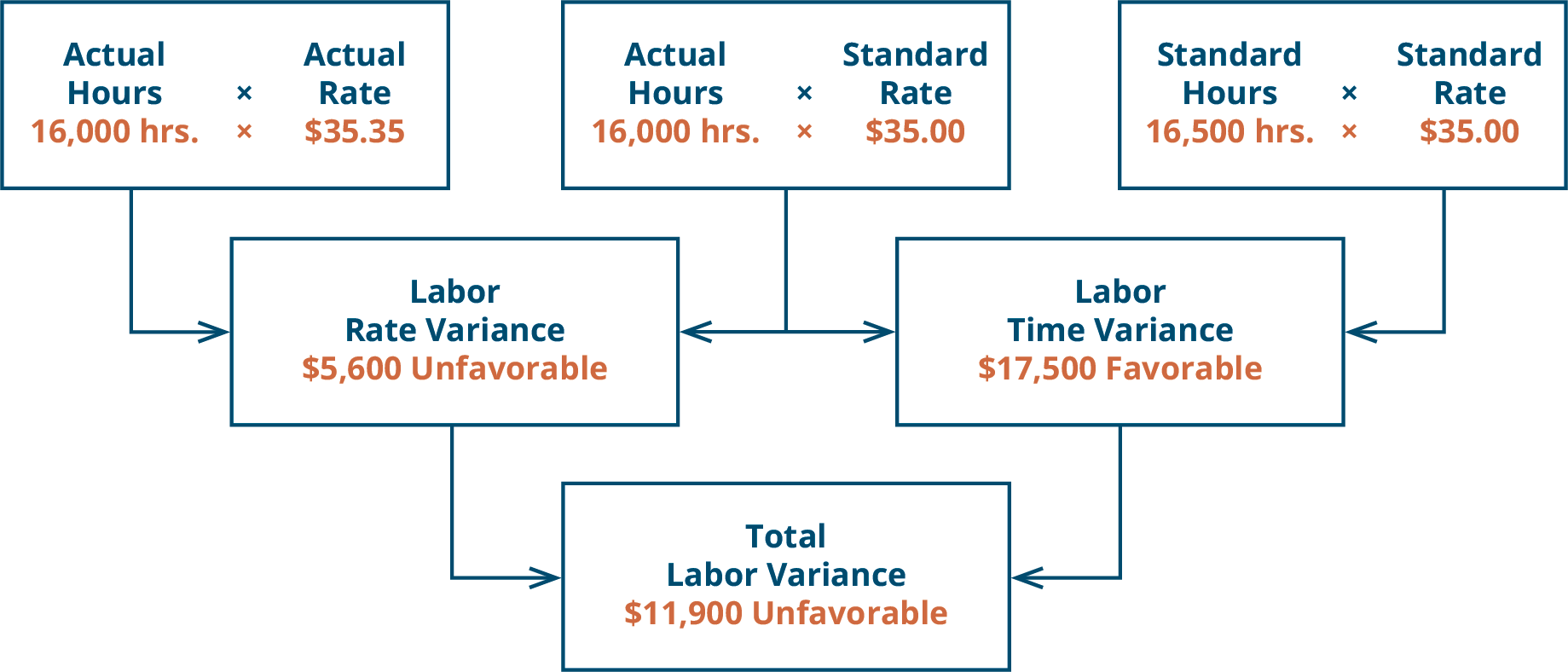

Doctors know the standard and try to schedule accordingly so a variance does not exist. If anything, they try to produce a favorable variance by seeing more patients in a quicker time frame to maximize their compensation potential. Calculate the labor rate variance, labor time variance, and total labor variance. By understanding the causes of labor variances and implementing targeted corrective actions, companies can enhance labor cost control, improve efficiency, and boost overall productivity. Regular analysis and interpretation of labor variances are essential for maintaining financial health and operational effectiveness. The quality of training and supervision significantly affects labor efficiency.

Submit to get your question answered.

Background Company A, a mid-sized manufacturing firm, experienced significant fluctuations in its labor costs over several quarters. Upon analyzing their financial statements, management identified a persistent unfavorable labor rate variance. Changes in the labor market, such as a shortage of skilled workers or new labor agreements, can lead to wage adjustments.

About Dummies

Since this measures the performance of workers, it may be caused by worker deficiencies or by poor production methods. Labor mix variance is the difference between the actual mix of labor and standard mix, caused by hiring or training costs. Calculating DLYV can help organizations better control their labor costs, optimize production processes, and improve overall profitability. It also provides insights into the effectiveness of human resource management initiatives. Before we take a look at the direct labor efficiency variance, let’s check your understanding of the cost variance.

Labor Efficiency Variance

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Mark P. Holtzman, PhD, CPA, is Chair of the Department of Accounting and Taxation at Seton Hall University.

The total actual cost direct labor cost was $1,550 lower than the standard cost, which is a favorable outcome. Hitech manufacturing company how to prevent a tax hit when selling a rental property is highly labor intensive and uses standard costing system. The standard time to manufacture a product at Hitech is 2.5 direct labor hours.

In this case, the actual hours worked per box are 0.20, the standard hours per box are 0.10, and the standard rate per hour is $8.00. This is an unfavorable outcome because the actual hours worked were more than the standard hours expected per box. As a result of this unfavorable outcome information, the company may consider retraining its workers, changing the production process to be more efficient, or increasing prices to cover labor costs. Direct labor rate variance is equal to the difference between actual hourly rate and standard hourly rate multiplied by the actual hours worked during the period.

He has taught accounting at the college level for 17 years and runs the Accountinator website at , which gives practical accounting advice to entrepreneurs. After filing for Chapter 11 bankruptcy in December 2002, United cut close to $5,000,000,000 in annual expenditures. As a result of these cost cuts, United was able to emerge from bankruptcy in 2006. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- For Jerry’s Ice Cream, the standard allows for 0.10labor hours per unit of production.

- As mentioned earlier, the cause of one variance might influence another variance.

- This results in an unfavorable labor rate variance of $2,000, indicating that the company spent $2,000 more on labor than anticipated due to higher wage rates.

- The labor standard may not reflect recent changes in the rates paid to employees.

If the outcome is unfavorable, the actual costs related to labor were more than the expected (standard) costs. If the outcome is favorable, the actual costs related to labor are less than the expected (standard) costs. The standard cost of direct labor and the variances for the February 2023 output is computed next. The following equations summarize the calculations for direct labor cost variance.

During June 2022, Bright Company’s workers worked for 450 hours to manufacture 180 units of finished product. The standard direct labor rate was set at $5.60 per hour but the direct labor workers were actually paid at a rate of $5.40 per hour. Find the direct labor rate variance of Bright Company for the month of June. Analyzing labor variances is critical for effective cost management and operational efficiency. It provides insights into how well a company controls its labor costs and utilizes its workforce.