What Is Account Reconciliation?

$79 billion the hidden climate costs of U S. materials production

دسامبر 28, 2022Web Design Kinds: Complete Guide

فوریه 1, 2023

This involves a few steps to ensure everything is accurate and ready for presentation. Once you’ve got your bank data in, it’s time to enter information from your company’s 4 ways to calculate depreciation on fixed assets records. Follow the same process—consistency and accuracy are your best friends here. Creating a reconciliation report in Excel can feel a bit like solving a mystery.

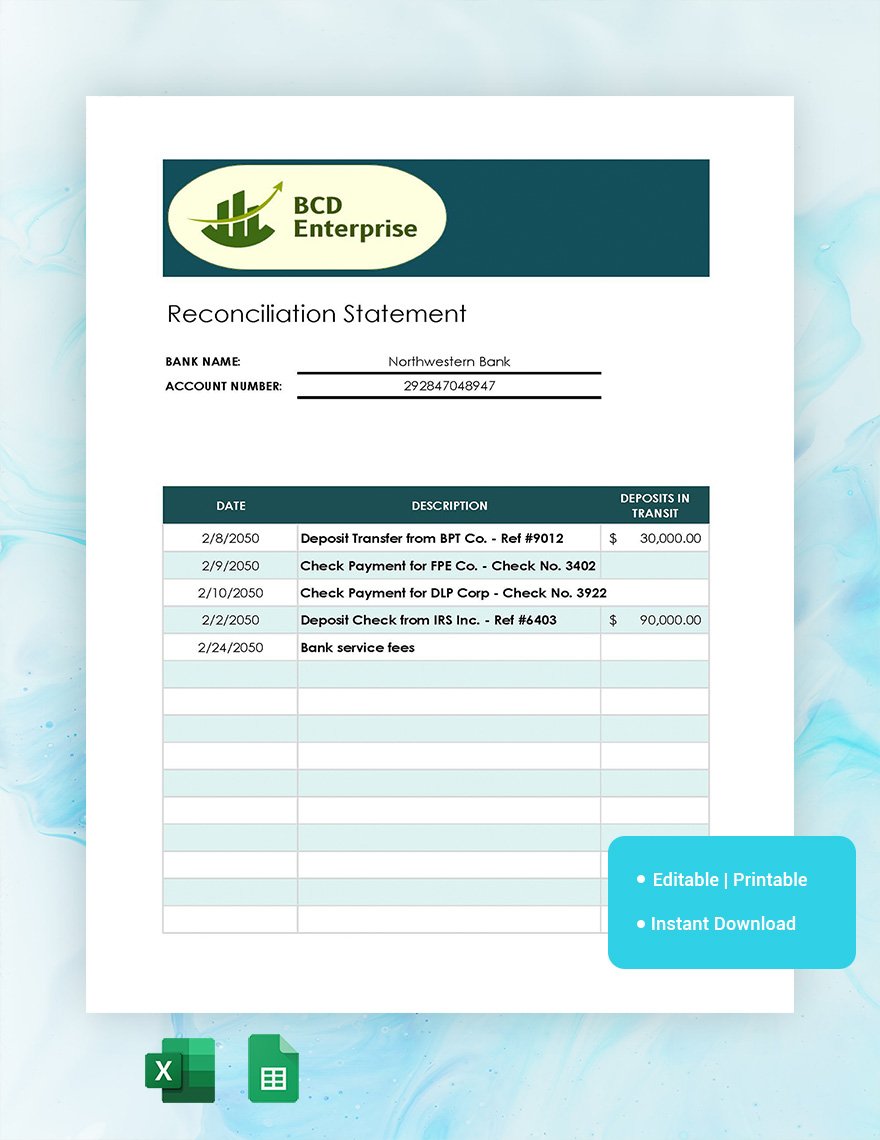

Inputting Data: The Backbone of Your Report

Without reconciling costs, businesses may run the risk of operating from incorrect financial information, leading to the potential for mismanagement of funds. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing our financial performance, such as our cost of capital and tax structure, as well as the historic cost of depreciable and depletable assets. Our computations of Adjusted EBITDA, Free Cash Flow, Adjusted Net Income (Loss), and Adjusted General and Administrative Expenses may not be comparable to other similarly titled measures used by other companies. Adjusted EBITDA, Free Cash Flow, Adjusted Net Income (Loss), and Adjusted General and Administrative Expenses should be read in conjunction with the information contained in our financial statements prepared in accordance with GAAP. “We generated Adjusted EBITDA(1) of $67 million in the third quarter, a 10% decrease from the second quarter of 2024, driven by lower oil prices and partially offset by lower lease operating expenses on a hedged basis and Adjusted G&A(1) expenses. Cash Flow from Operations totaled $71 million which was flat with the second quarter and Free Cash Flow(1) was $45 million, a 55% increase over the second quarter, driven by lower capital expenditures consistent with our expectations.

How to Use the VARP Function in Excel: A Step-by-Step Guide

Compare the cost components across different periods, phases, or segments of the project or process. This is another useful way of analyzing cost components, especially for long-term or complex projects or processes that involve multiple stages or parts. You can compare the cost components for different periods (such as months, quarters, or years), phases (such as planning, execution, or closure), or segments (such as locations, departments, or activities) of the project or process. This will help you to see if there are any trends, patterns, or anomalies in the cost components over time or across different aspects of the project or process. For example, you may find that the cost of equipment increased significantly in the last quarter of the project because of a breakdown or a maintenance issue. Or you may find that the cost of overhead was higher in one location than in another because of a difference in the tax rate or the rent.

Do you already work with a financial advisor?

Reconciliation represents the process of tallying the working results or profits as shown by cost accounts with those of financial accounts. Meanwhile, a financial accountant maintains financial accounts as per the principles of financial accounting to record day-to-day transactions and find out their net effect on the profitability and financial position of the business. So from our example above, we have 4925 equivalent units of production using the weighted average method. If our total cost of our beginning WIP inventory was $1,000 and we added $10,000 during the period.

Future Trends in Cost Management and Reconciliation

Additionally, it can help identify errors in transactions or accounting norms. Because CVR is a documented/recorded process, construction companies are able to use previously produced CVR reports as guidance on how to correctly cost future construction projects. CVRs are great for understanding previous mistakes and improving cost evaluations for the future.

- The next step is to compare the actual costs incurred by the business with the planned or budgeted costs for the same period and scope.

- Under-absorption of indirect expenses occurs when the amount charged for indirect expenses in financial accounts is lower than the amount actually incurred.

- Trust me, a little organization at the beginning can save a lot of headaches later on.

- For example, the use of spreadsheets, databases, software, and applications that can perform calculations, validations, reconciliations, and adjustments of cost data automatically and accurately.

If the actual costs are lower than the baseline budget, project managers need to identify the reasons for the cost savings and determine how to allocate the savings. By regularly generating CVR reports, construction contractors can ensure that they are delivering projects in the most cost-effective and timely manner possible. Equivalent units represent the total amount of work done on incomplete units, expressed in terms of fully completed units. It is used to determine the cost per equivalent unit in a production process. Construction projects encompass a variety of expense categories that are subject to both planned and unplanned changes. At the same time, monitoring, analyzing, and controlling costs effectively is no longer optional when it comes to meeting aggressive budgets and ensuring profitability.

Businesses that prioritize effective reconciliation practices put themselves in a strong position to make informed decisions, mitigate risks, and maintain the financial health necessary for long-term success. The production cost report for the month of May for the Assemblydepartment appears in Figure 4.9. Notice that each section of thisreport corresponds with one of the four steps described earlier. Weprovide references to the following illustrations so you can reviewthe detail supporting calculations. We will calculate a cost per equivalent unit for each cost element (direct materials and conversion costs (or direct labor and overhead). A construction firm could use project management software that integrates cost tracking, making reconciliation more efficient and reducing human error.

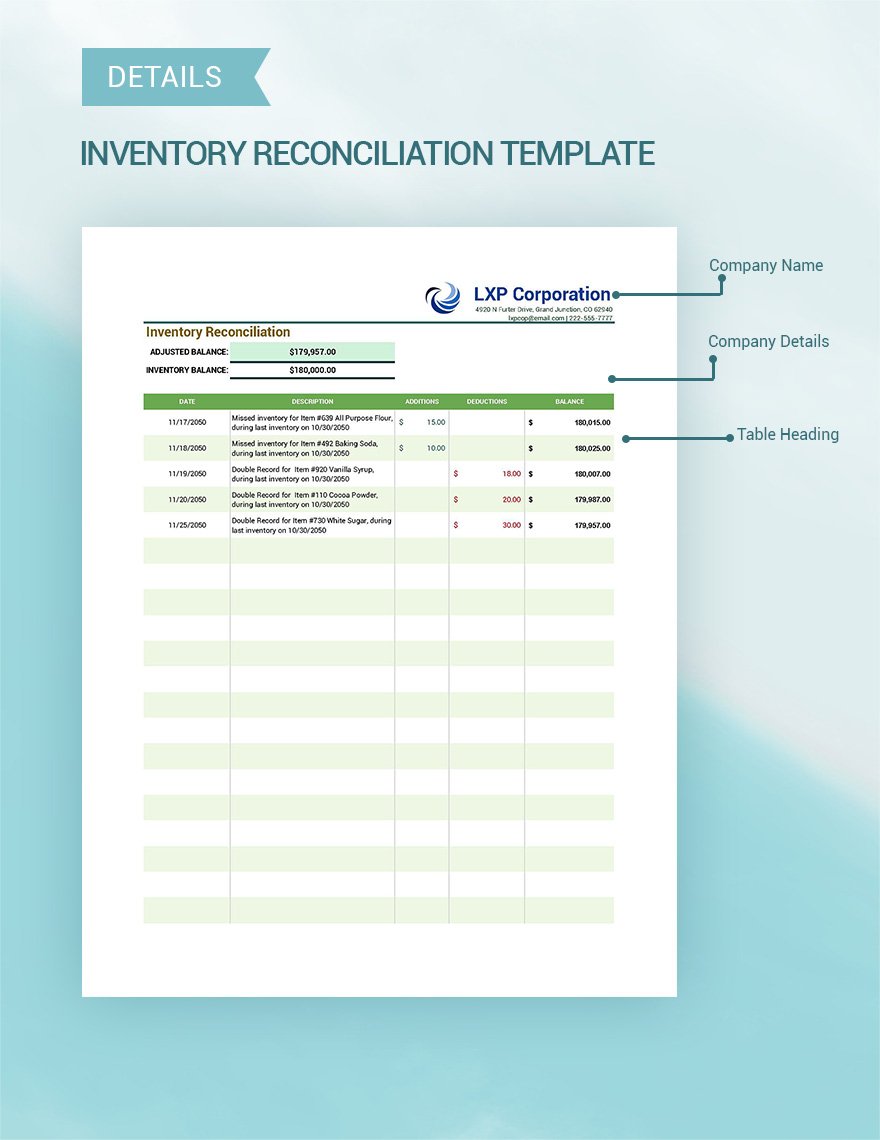

The results should be presented in a clear and concise manner, using tables, charts, or graphs, and should highlight the key findings, insights, and recommendations. The results should also be used to evaluate the business performance, and to plan and implement the necessary actions to improve the cost management and profitability. To reconcile their costs, small businesses should collect and organize the relevant data from various sources, such as invoices, receipts, bank statements, and accounting software.

We believe this also makes it easier for investors to compare our period-to-period results with our peers. According to a survey conducted by the Association of Certified Fraud Examiners (ACFE), financial statement fraud constituted 9% of all reported fraud cases in 2022. This highlights the significance of accurate accounting reconciliation in detecting and preventing fraudulent activities within an organization. By reconciling financial records, such as bank statements, invoices, and receipts, businesses can identify discrepancies and irregularities and protect themselves against potential fraud. In the realm of financial management, the process of aligning projected costs with actual expenditures stands as a cornerstone for ensuring fiscal responsibility and transparency. This meticulous practice, often seen as a labyrinthine task, involves a series of steps that include identifying discrepancies, analyzing variances, and implementing corrective measures.

Formulas will help you identify discrepancies between your bank statement and company records. These trends highlight the importance of agility and foresight in cost management. As organizations navigate the complexities of financial operations, embracing these innovations will be key to maintaining accuracy, efficiency, and compliance in the years to come. By addressing these challenges head-on with strategic planning, meticulous record-keeping, and the integration of advanced reconciliation tools, organizations can mitigate risks and enhance the integrity of their financial reporting. However, cost accounts may follow the machine hour rate or production unit method of depreciation. Thus, reconciling the two sets of accounts will help to determine the correct results and, at the same time, test the reliability of cost accounts.

It can also help build trust, confidence, and satisfaction among the stakeholders, and resolve any potential issues or conflicts that may arise from the cost reconciliation process. This means that the cost reconciliation process should be supported by appropriate tools and systems that can facilitate the collection, verification, analysis, and reporting of cost data. For example, the use of spreadsheets, databases, software, and applications that can perform calculations, validations, reconciliations, and adjustments of cost data automatically and accurately. This can help reduce the manual work, human errors, and inconsistencies that may occur in the cost reconciliation process. It can also help improve the speed, accuracy, and quality of the cost reconciliation results and reports.